REE’s profit after tax for Q1 2022 saw significant growth, primarily driven by a 1.2-fold increase in the energy sector compared to the same period last year.

Refrigeration Electrical Engineering Corporation REE (Hose: REE) recently announced its Q1 2022 business results, with consolidated revenue reaching 2.045 trillion VND, up 72.9% over the same period.

However, the cost of goods sold rose to 895 billion VND, resulting in nearly a threefold increase in gross profit from sales and services compared to the same period last year, reaching 1.150 trillion VND.

During the period, REE’s financial activities were less favorable, with revenues dropping 66% to 38 billion VND due to a lack of earnings from the sale and liquidation of investments and foreign exchange rate differentials. Financial expenses, primarily interest on loans, also doubled to 217.5 billion VND.

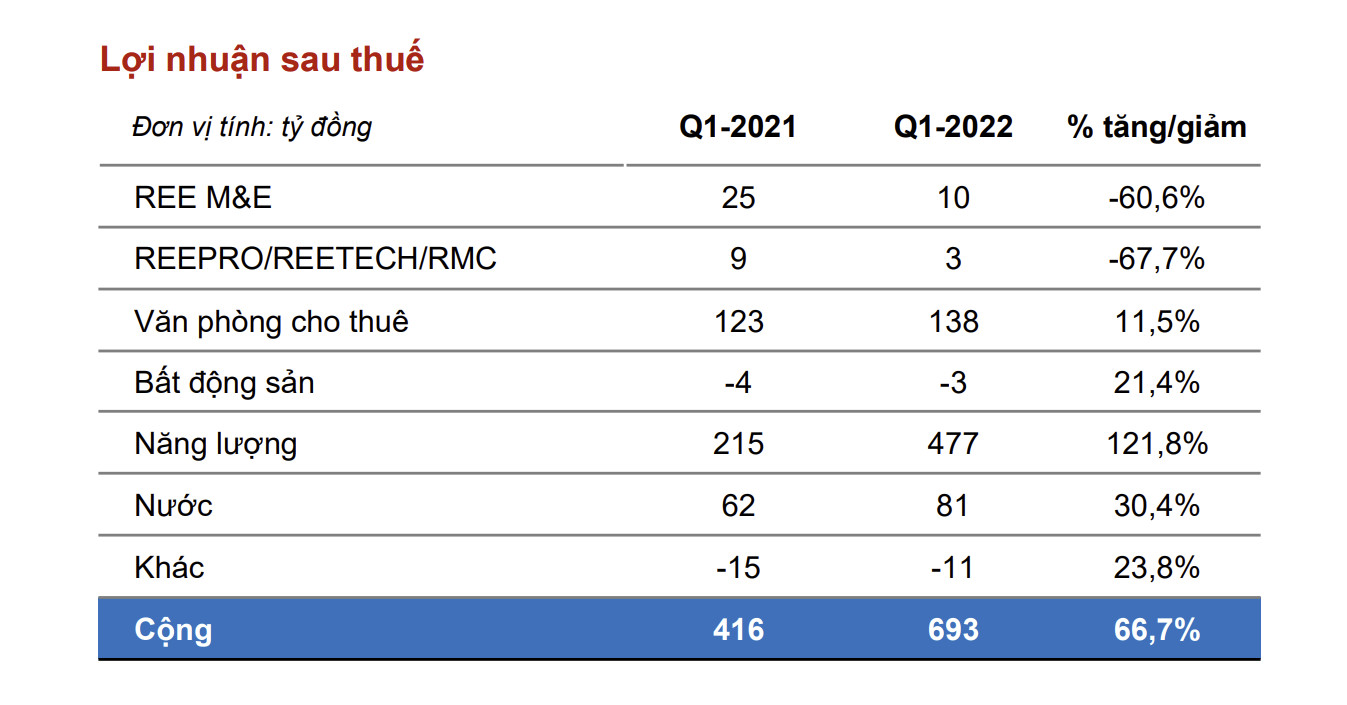

After deducting operating expenses, REE reported a post-tax profit of 955.3 billion VND, doubling the performance of Q1 2021, of which the profit attributable to the parent company’s shareholders was 693.3 billion VND, up 67%. Basic earnings per share also significantly increased from 1,345 VND to 2,236 VND.

Structure of contribution to the proportion of profit after tax by each segment of REE.

The energy sector contributed the most to REE’s revenue and profit structure. The total revenue of the energy segment in Q1 2022 reached 1.439 trillion VND, up 287% over the same period.

The hydropower sector alone contributed 343 billion VND to the profit share of the energy segment, up 183% over the same period, thanks to favorable hydrological conditions in the early months of the year and additional business results from the Thượng Kontum plant, with increased market electricity prices compared to Q1 2021.

Additionally, the wind power sector recorded additional production from three plants: Trà Vinh V1 -3, Phú Lạc 2, and Lợi Hải 2.

The second largest contribution to REE’s revenue and profit share came from the office leasing and real estate segment. By the end of Q1, the occupancy rate of the office buildings for lease reached 98%, with Etown 5 having a 100% occupancy rate.

The revenue and post-tax profit of the office leasing and real estate sector increased by 3.3% and 11.5%, respectively, compared to the same period last year, thanks to tenants gradually returning to offices after the Covid-19 pandemic.

In the mechanical, electrical, and trade services sector, the total contract value of M&E signed by the end of Q1 2022 reached 4.732 trillion VND, up 84.6% over the same period.

However, REE M&E’s revenue and post-tax profit decreased by 54.5% and 60.6%, respectively, compared to the same period, as projects were in the implementation phase, leading to less revenue and profit recognition due to projects not yet being completed.

As of March 31, 2022, REE’s total assets reached 32.402 trillion VND. At the end of Q1 2022, total debt was 11.939 trillion VND, equivalent to the figure at the beginning of the year. The net debt-to-equity ratio was 51.7%.

The total long-term debt to banks at the end of Q1 2022 was 8.230 trillion VND, with interest rates ranging from 5.2% to 9.75%. Long-term bond debt was nearly 2.472 trillion VND. In the first three months of the year, REE’s total interest expense was nearly 214 billion VND.

For 2022, REE set a revenue target of 9.279 trillion VND and a post-tax profit of 2.064 trillion VND. Thus, at the end of Q1 2022, REE had achieved 22% of its annual revenue plan and 46.2% of its annual profit plan.

Recently, REE announced that on May 18, it would finalize the list of shareholders to receive the 2021 dividend, at a rate of 15% in shares, meaning shareholders owning 100 shares will receive 15 new shares. After the issuance, REE’s charter capital will increase to over 3.564 trillion VND.

Previously, REE also finalized the rights to receive cash dividends at a rate of 10%, corresponding to a payout of about 310 billion VND.

Source: